In the fast-paced world of financial markets, trading indices have gained significant popularity among investors and traders alike. Indices trading allows individuals to gain exposure to the performance of an entire market or a specific sector rather than investing in individual stocks. In this blog, we will explore the concept of trading indices, discuss the benefits of choosing indices over stocks, and identify some of the top indices to trade. So, if you’re interested in expanding your trading portfolio and diversifying your investments, read on to discover how an indices trading academy can help you achieve your goals.

What is Indices Trading?

Trading indices involve speculating on the price movements of a collection of stocks that represent a particular market or sector. The value of an index is a weighted average of the individual stocks within it, providing a snapshot of the overall market performance. Investors use them to capitalise on the collective performance of these stocks rather than selecting and trading individual companies.

Indices are usually classified based on market capitalisation, sector, or region. Some popular examples of indices include the S&P 500, Dow Jones Industrial Average (DJIA), NASDAQ Composite, and the FTSE 100.

How To Learn Indices Trading

For those new to trading indices, acquiring the necessary knowledge and skills is essential to make informed decisions. Enrolling in an indices trading academy like Queensway Academy can be a smart step to begin your journey. These academies offer courses and resources designed to educate aspiring traders on the fundamentals of trading indices, technical analysis, risk management, and more.

Through comprehensive learning modules, expert-led webinars, and practical exercises, participants can gain valuable insights into the dynamics of trading indices. Additionally, they can access real-time market data and historical trends, honing their analytical abilities for better trading strategies.

Why Trade Indices over Stocks?

Indices trading offers several advantages over traditional stock trading, making it an attractive option for many investors:

- Diversification: Trading indices allow investors to spread their risk across multiple companies within a specific market or sector. Diversification is a useful strategy that helps reduce the negative impact of any individual stock’s poor performance on the entire portfolio.

- Efficiency: Monitoring and analysing a single index is more efficient than researching individual stocks. Investors can focus on understanding broader market trends rather than delving into the complexities of numerous companies.

- Liquidity: Major indices generally have high liquidity due to the large number of stocks they represent. This liquidity ensures that traders can easily enter and exit positions without significant price fluctuations.

- Reduced Volatility: Individual stocks may experience wild price swings due to company-specific news or events. In contrast, indices are less prone to such extreme volatility, providing a more stable trading environment.

Top Indices to Trade

While numerous indices are available for trading, some of the most popular and widely traded indices include

- S&P 500 (US):

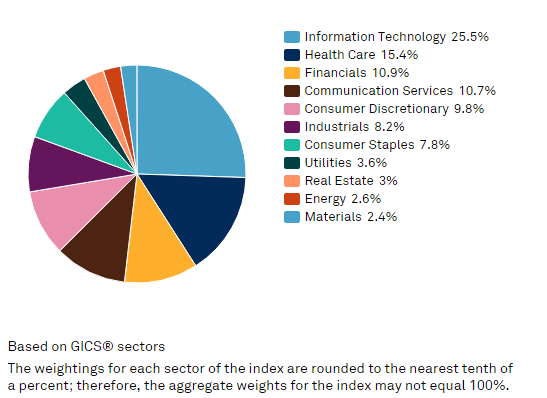

The S&P 500 is one of the most widely followed stock market indices globally. It represents the 500 largest publicly traded companies in the United States, encompassing a broad range of industries. As a benchmark for the US stock market, the S&P 500 provides valuable insights into the overall health and performance of the American economy.

- NASDAQ-100 (US):

The NASDAQ-100 is renowned for its focus on technology and growth-oriented companies. This refers to a group of 100 major non-financial corporations that are publicly listed on the NASDAQ stock exchange. With tech giants like Apple, Microsoft, Amazon, and Google among its constituents, this index attracts traders interested in the technology sector.

- Dow Jones Industrial Average (DJIA) (US):

The DJIA is one of the oldest and most iconic indices globally. It consists of 30 large, publicly traded companies representing various industries. While it is a smaller and less diversified index compared to the S&P 500, it still holds significant importance in the financial world and is closely monitored by investors.

- FTSE 100 (UK):

The Financial Times Stock Exchange 100 Index, commonly known as the FTSE 100, tracks the 100 largest companies listed on the London Stock Exchange. It provides insight into the performance of the UK’s leading publicly traded companies across different sectors.

- Nikkei 225 (Japan):

The Nikkei 225 is Japan’s premier stock market index, representing the top 225 companies listed on the Tokyo Stock Exchange. It offers a snapshot of Japan’s economic performance and is particularly relevant for traders interested in the Asian markets.

- DAX 30 (Germany):

The DAX 30 is Germany’s flagship stock market index, comprising the 30 largest and most actively traded companies on the Frankfurt Stock Exchange. As Europe’s largest economy, the DAX 30 reflects trends and developments within the region.

Conclusion

Trading indices offer a compelling alternative to individual stock trading, providing diversification, efficiency, liquidity, and reduced volatility. As with any form of trading, it’s essential to educate yourself thoroughly before entering the market. Enrolling in a trading academy can equip you with the necessary knowledge and tools to make well-informed decisions.

When choosing the best indices to trade, consider your investment goals, risk tolerance, and market outlook. By carefully analysing market trends and utilising sound trading strategies, you can harness the potential of trading indices to grow your wealth and achieve your financial objectives. Happy trading!